5 Simple Steps to Build a Balanced Portfolio in 2025

Discover a step-by-step guide to building a balanced investment portfolio in 2025. Learn how to diversify using asset allocation principles, avoid common mistakes, and use smart tools to keep your investments on track—explained in a way anyone can understand, with a surprising twist that makes investing both simple and powerful.

STRATEGY

6/19/20253 min read

Picture this: You’re on a game show, and the host says, “You can put all your eggs in one basket… or you can spread them out and win big, even if a few eggs crack!” That’s the suspenseful secret behind building a balanced investment portfolio in 2025—diversification. Let’s break down how you can create a resilient, growth-focused portfolio, even if you’re just starting out.

Why a Balanced Portfolio Matters

A balanced portfolio is like a well-packed survival kit for your financial future. It helps you weather market storms, smooth out wild swings, and keep your money growing steadily over time. In 2025, with markets more unpredictable than ever, diversification isn’t just smart—it’s essential.

Step 1: Know Your Goals and Risk Tolerance

Before you invest a single dollar, ask yourself:

What am I investing for? (Retirement, college, a dream vacation?)

How much risk can I handle? (Can you sleep at night if your investments drop 10%?)

When will I need the money? (Next year, or in 20 years?)

Your answers will shape your asset allocation—the mix of investments you choose.

Step 2: Understand the Main Asset Classes

To diversify, you need to know your options. Here are the main asset classes for 2025:

Stocks (Equities): Offer growth but can be volatile. Include U.S. and international stocks, and consider different sectors like tech, healthcare, and consumer goods.

Bonds (Fixed Income): Provide stability and income. Mix government, corporate, and international bonds to cushion against stock market drops.

Real Assets: Real estate and commodities (like gold) can hedge against inflation and add stability.

Alternative Investments: Think private equity, hedge funds, or even cryptocurrencies for extra diversification, but only as a small slice of your portfolio.

Cash and Equivalents: Keep some cash handy for emergencies or opportunities.

Step 3: Decide Your Asset Allocation

This is where the magic happens. Asset allocation is the process of deciding what percentage of your money goes into each asset class. Here’s how to approach it:

Younger investors: Can usually take more risk, so a higher percentage in stocks makes sense.

Closer to retirement: Shift more toward bonds and stable assets to protect your nest egg.

A classic “balanced” portfolio might look like 60% stocks, 30% bonds, and 10% alternatives or cash—but your mix should fit your goals and comfort level.

Step 4: Diversify Within Each Asset Class

Don’t just buy one stock or one bond fund. Spread your investments out:

Stocks: Invest in different sectors (tech, healthcare, energy) and regions (U.S., Europe, emerging markets).

Bonds: Mix short-term and long-term, government and corporate, domestic and international.

Real Assets & Alternatives: Consider real estate investment trusts (REITs), commodities, or a small allocation to crypto if you’re comfortable with risk.

Step 5: Avoid Common Diversification Mistakes

Even the best plans can go off the rails. Watch out for these pitfalls:

Overdiversification: Spreading your money too thin can dilute returns. Keep your portfolio focused and intentional.

Ignoring Correlation: Don’t add assets that move in the same direction. True diversification means picking investments that react differently to market events.

Chasing Trends: Don’t pile into the latest hot sector (like meme stocks or AI) without balance and research.

Forgetting to Rebalance: Markets change. Review your portfolio at least once a year and adjust back to your target allocation.

Step 6: Use Smart Tools and Stay Consistent

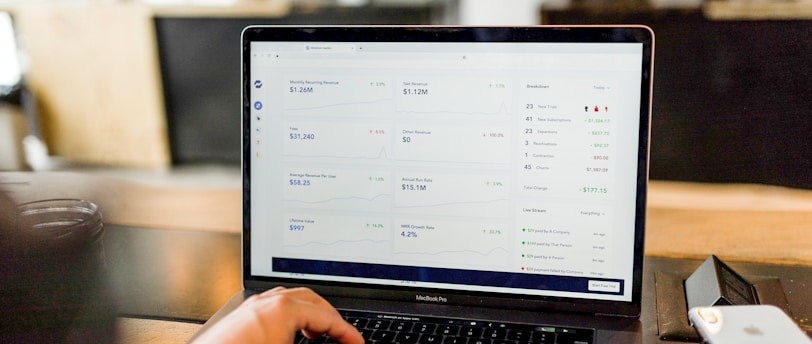

Robo-Advisors: Platforms like Wealthfront or Betterment can automate diversification based on your goals and risk tolerance.

Regular Contributions: Invest consistently, even during market dips. This strategy, called dollar-cost averaging, can help smooth out volatility.

Review and Adjust: Life changes, and so should your portfolio. Revisit your goals and allocations regularly—especially after big life events.

The Surprising Twist: The Power of Boredom

Here’s the twist: The most successful investors in 2025 aren’t the ones glued to their screens, chasing every market move. They’re the ones who build a balanced portfolio, stick to their plan, and let time do the heavy lifting. Sometimes, the best investment strategy is… a little bit boring! But boring can be beautiful when it comes to growing your wealth.

Quick Recap: Steps to Build a Balanced Portfolio in 2025

Define your goals and risk tolerance

Learn about different asset classes

Choose your asset allocation

Diversify within each asset class

Avoid common mistakes

Use smart tools and review regularly

Conclusion: Ready to Balance Like a Pro?

Building a balanced portfolio in 2025 is about mixing the right ingredients for your financial recipe. With a thoughtful approach to asset allocation and diversification, you can ride out market storms and keep your money working for you—no matter what surprises the future brings.